A New Landscape: Venture Capital and Cybersecurity in Q3 & Q4 2023

Navigating Down Rounds, Embracing the New Normal, and Fostering Startup Growth in the European Ecosystem

Hello Cyber Builders ✌️

Understanding current trends and market dynamics is crucial for entrepreneurs, investors, and industry observers in the ever-evolving landscape of venture capital and cybersecurity. The post-pandemic era has significantly changed, steering these sectors back towards pre-pandemic norms.

With a blend of data analysis, expert insights, and industry reports, I delve into the intricacies of these shifts, offering a comprehensive view of what's happening on the ground. This blog post aims to dissect the latest trends from Q3 2024, understand their implications, and explore what the future 2024 might hold for Cyber Builders, particularly in the European context.

In This Post

Venture Capital Trends: Examining how venture capital funding in cybersecurity is stabilizing

Cybersecurity Industry Dynamics: A deep dive into the current state of the cybersecurity industry, focusing on the financial recalibration, increasing down-rounds, and the implications for startups seeking funding.

European Market Outlook: Exploring the vitality of the European market, highlighting critical sectors like cybersecurity and AI, and discussing the implications for new and existing enterprises.

VC Funding Realignment: A Return to Rationality

As the dust settles in the venture capital landscape, recent trends indicate a significant shift to pre-pandemic norms. According to the latest data from Crunchbase, venture capital funding in the cybersecurity sector has been experiencing a noticeable stabilization in the third quarter, aligning with the levels observed in 2019. This change departs from the heightened investment activity spurred in 2021 and 2022.

While the current trend doesn't signify a dramatic crash, it reflects a normal marketization. The number of deals and the volume of investments are stabilizing, suggesting that the market is entering a mature, sustainable growth phase rather than continuing its previous rapid expansion. The more pragmatic pre-money valuation also reflects more realistic business plans and valuations.

The implications of this shift are multifaceted for entrepreneurs and security practitioners in the cybersecurity field. On one hand, the return to pre-pandemic funding levels indicates a more cautious and perhaps more strategic approach from venture capitalists. Startups in the cybersecurity space might now face a more challenging environment when seeking funding, necessitating a stronger emphasis on demonstrating tangible value and innovation. On the other hand, this normalization can be seen as a positive sign of market maturity, where investments are driven by long-term potential rather than short-term trends.

For the community catalyzed by Cyber Builders, this could mean a renewed focus on developing robust, sustainable cybersecurity solutions that address the market's evolving needs.

Cybersecurity Sector: Adjusting to a New Financial Reality

The cybersecurity industry is navigating through a phase of financial recalibration, marked by an increasing number of down-rounds. This phenomenon, where companies receive funding at valuations lower than their previous rounds, becomes more prevalent as the industry adjusts to a new market reality. Notably, many startups that secured substantial investments at high valuations during the boom years of 2021 and 2022 are now confronting slower growth trajectories. Consequently, these companies are increasingly focusing on sustainability - boards are asking to “cut the burn”- often involving workforce reductions and a strategic return to fundamental business practices “grow without crazy spending.”

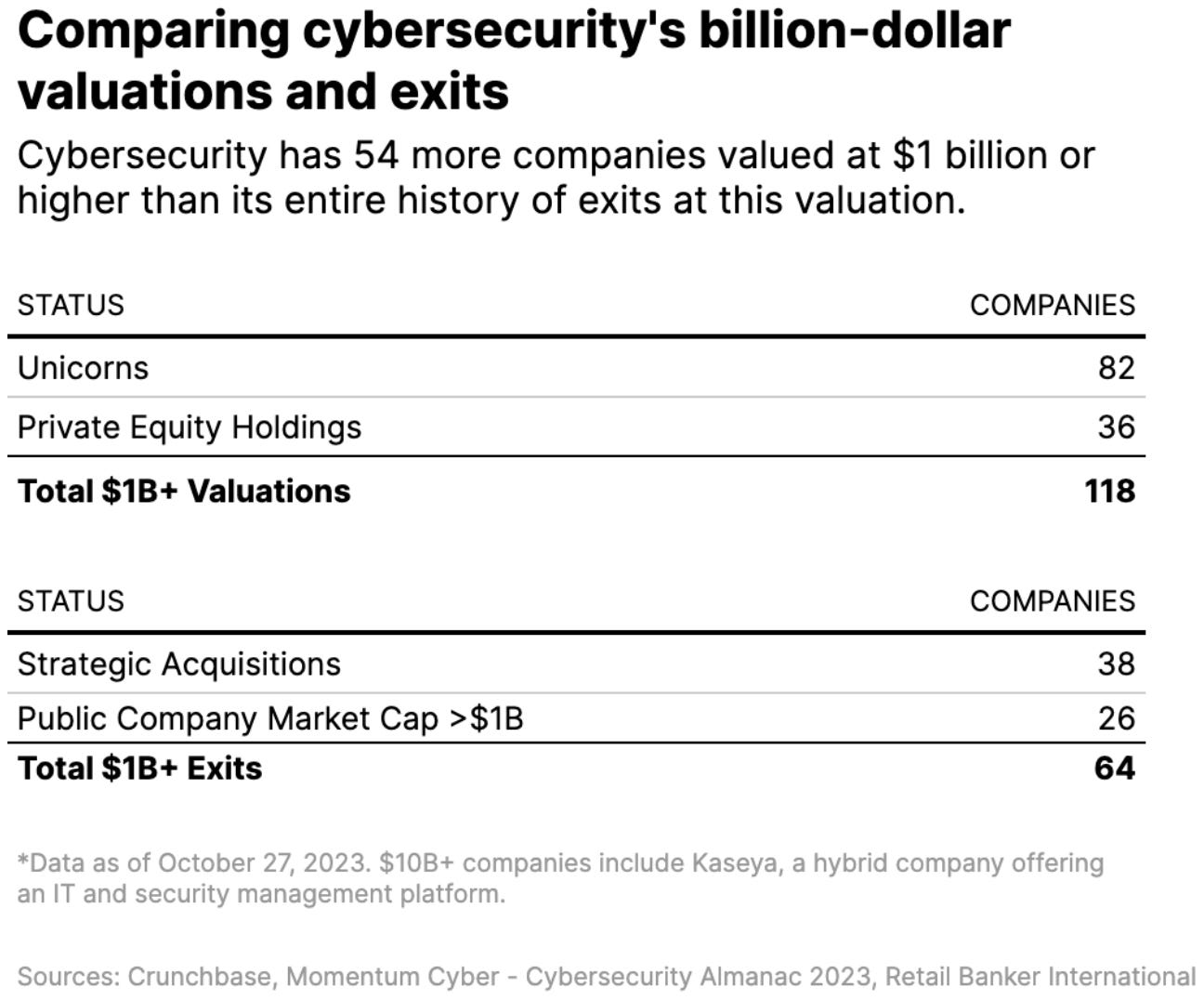

This trend is vividly illustrated in the graphs provided by Strategy of Security.

In the upper echelons of the cybersecurity market, the concentration of high-value unicorns is more pronounced than ever. This is probably a concern resulting from the unbounded valuation, like 20x the ARR - I covered this in “Riding the Investment Wave.”

*We've had 64 companies achieve billion-dollar exits. We're expecting 118 more companies to do the same. And we're expecting those exits to happen soon.

It sure seems there aren't enough chairs when the music stops.*

Cole Grolmus - https://strategyofsecurity.com/about/

Looking beyond mere valuations to consider market exits reveals an industry at a crossroads. With 82 companies classified as unicorns and 36 held by private equity, there's a significant backlog of firms in the cybersecurity sector with valuations over $1 billion—a total of 118 that eclipses the historical number of exits at this valuation. The exit market is less populated, with only 38 strategic acquisitions and 26 public company market capitalizations exceeding $1 billion. This data suggests an impending bottleneck; while plenty of high-value players are on the field, the opportunities to exit at such valuations are comparatively scarce. This discrepancy signals a future where exits become more competitive, potentially leading to a consolidation in the market or a new wave of down rounds.

This trend goes beyond cybersecurity sectors, as an article from Sifted reminds us: According to PitchBook, 21.3% of raises this year resulted in a downround, as median valuations across all stages fell. This is the highest level since 2014.

Startups on the Edge: Navigating Increased Shutdowns

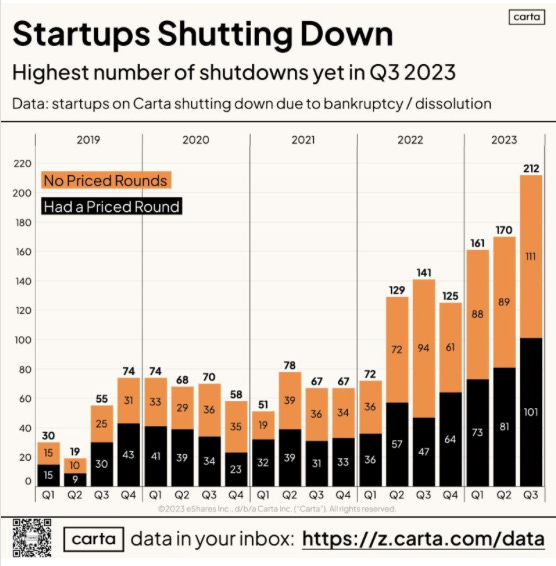

In 2023, there has been a significant increase in the number of startup shutdowns compared to the previous year.

Based on Carta, about half of the closed startups did not raise any VC rounds, while the other half had at least one priced round in their history. Most shutdowns were Seed or Series A startups, but there were notable shutdowns among Series B or later startups. Additionally, the number of shutdowns among startups that raised at least $10 million has nearly doubled compared to last year. This has been a challenging year for startups, and while the fundraising market is expected to improve, shutdowns are likely to continue at an elevated pace for the next 2-3 quarters.

European Market Pulse: Growth and Challenges

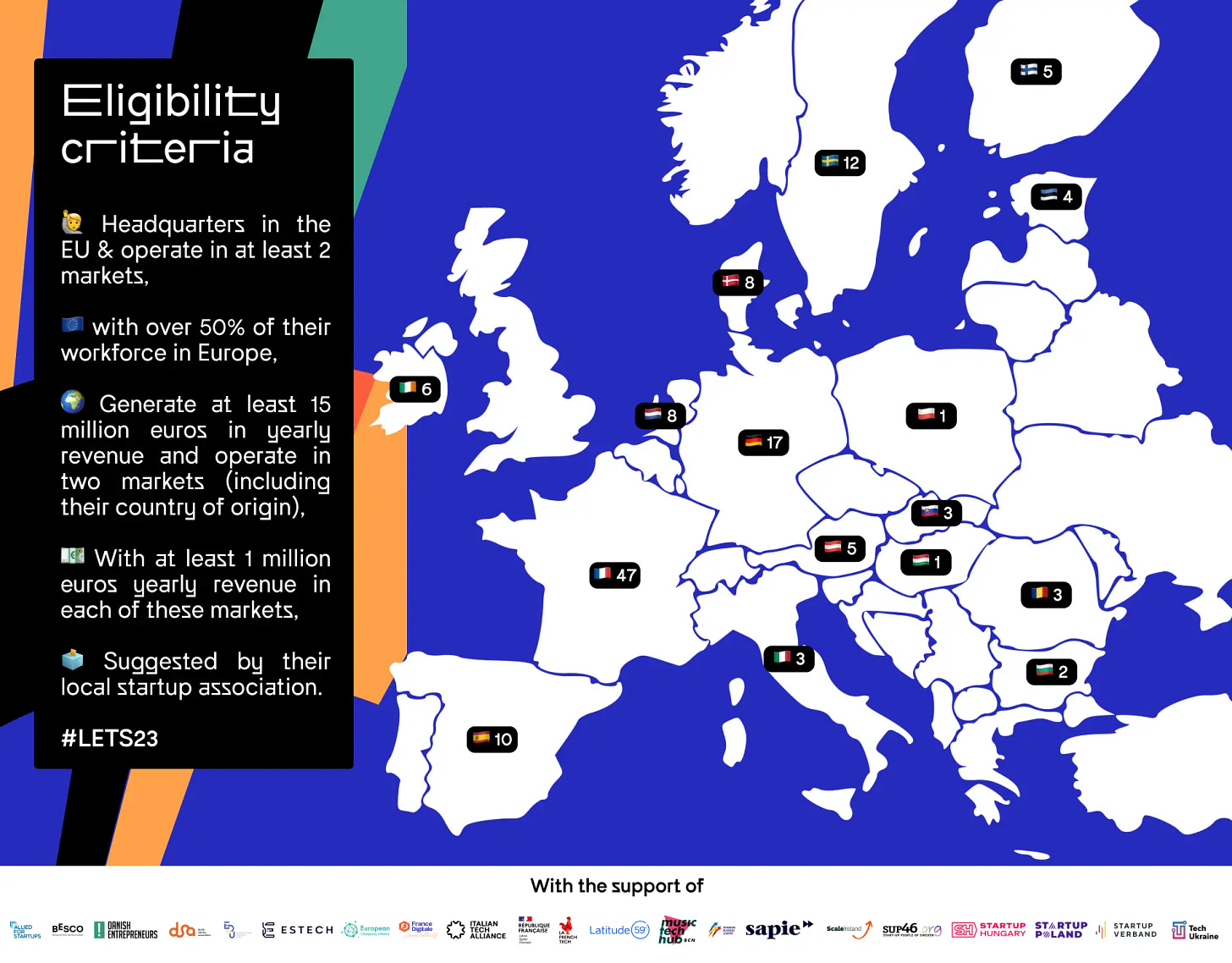

In this context, Europe remains a fantastic playing field for new enterprises. Several studies published in Q3 highlight the vitality of Europe and the determination of a generation of European entrepreneurs to anchor their companies in their local ecosystems. France Digitale has published its study, and we can see the financial metrics of the European market remain strong.

Moreover, as Axeleo Capital points out, seed funding for startups continues to be robust, as evidenced by the acceleration of capital in the cybersecurity sector. The UK is the leading country, followed by France and Germany. IAM is a strong cybersecurity sector with IoT and hardware security startups. Note that Cloud security is underrepresented in Europe, which is concerning.

Accel’s Euroscape is out, and I recommend you read that report! Seeing the dynamic startup ecosystem from Europe / the UK / Israel is energizing. It is far from the naysayers disserting about “the nonculture of entrepreneurship” in Europe…

The US VC firm is still bullish on the innovation potential in Europe based on the Generative AI and Cybersecurity sectors, among others. Read more within the Accel 2023 Euroscape report and see the complete list of 100 SaaS companies to watch.

Two charts struck me:

Euroscape Index shows that multiples are reverting to 10-year pre-COVID averages. On the private side, cloud financing and unicorn creation have converged to pre-COVID levels.

The other chart is the global AI race. It highlights that Europe is full of talent in engineering and science, two topics material for AI and deep tech in general.

Innovating into the Future: The Unabated Role of Startups

Startup bashing happens occasionally, and the media likes big titles like “The startup nations are over.” It is not valid. It is false.

The era of startups and their ability to revolutionize the economy through innovation and technology is not over. While social relationships within startups may not be fundamentally different from traditional companies - something many praised ten years ago- there is still a need for startups, innovation, and digital solutions in sectors like cybersecurity, healthcare, biotechnology, and space to address ecological transition, defend European values, balance society and improve healthcare.

Conclusion

Embracing Change: The Path Forward in Venture Capital, Cybersecurity, and Startups

As we've explored in this post, the landscapes of venture capital, cybersecurity, and startups are undergoing significant changes. These sectors are realigning towards a more pragmatic and sustainable approach post-pandemic. The shifts we're witnessing today are not just temporary adjustments but could be the new foundation for future growth and innovation.

For entrepreneurs, investors, and industry professionals, understanding these trends is crucial for making informed decisions and strategizing for the future. The challenges are real, but so are the opportunities that come with change. It's a time for resilience, strategic thinking, and, most importantly, adaptability.

Stay Tuned for Next Week!

And there's more to come. Next week, we'll dive into the "Back to Basics" concept and explore essential SaaS metrics. We'll look at how startups can focus on fundamental business practices to grow sustainably and efficiently in this new market reality. This is particularly crucial for those navigating the challenging waters of venture capital and seeking to build resilient, long-term business models.

So, stay tuned for this upcoming post, where I will break down complex concepts into actionable insights. Your engagement and feedback are always welcome, so feel free to share your thoughts and suggestions, as Cyber Builders is a community play.

Thank you for reading, and don't forget to share!

Resources:

Axeleo Capital 5th Cybersecurity Index - https://www.axc.vc/blog-posts/axeleo-capitals-5th-edition-of-the-cybersecurity-index

LETS 2023, the mapping of 135 Leading European Tech Scale-ups that are succeeding globally - https://francedigitale.org/publications/lets-2023

Strategy of Security - https://strategyofsecurity.com/no-way-out-the-changing-world-of-cybersecurity-exits/

Crunchbase - https://news.crunchbase.com/cybersecurity/big-rounds-venture-startups-unicorn-island/

Carta & Saast - https://www.saastr.com/carta-startup-shutdowns-are-up-237/

Accel Euroscape 2023 - https://www.accel.com/euroscape

Sifted “European tech down rounds hit highest levels since 2014 as valuations continue to tumble” - https://sifted.eu/articles/q3-european-vc-pitchbook