Understanding Venture Capital Trends in Cybersecurity: A Deep Dive into 2023 📉

Decline in Funding, Fewer Startups, What VC and LP are looking, How much Founders pay themselves and more...

Hello Cyber Builders 🖖

In this article, we will discuss the state of the venture capital market in Q2 2023, particularly in the cybersecurity industry. While the past few years have seen intense venture funding across all technology companies, the situation has changed significantly. We will look at data from several sources to explore this shift and its implications. Additionally, we will examine the outlook for the industry and opportunities for entrepreneurs. (All sources and articles are provided as links in the text; feel free to follow the links.)

Checkout also my previous post on the VC / investment market in Q1 2023 (🔗 here)

Let's dive in.

Easy money is gone.

Venture funding was intense across all technology companies in 2020 and 2021, and cyber security was no exception.

However, as Crunchbase reminds us, this period is over. Cyber security funding for the second quarter of 2023 was only around $1.6 billion, representing a 63% drop compared to last year's quarter.

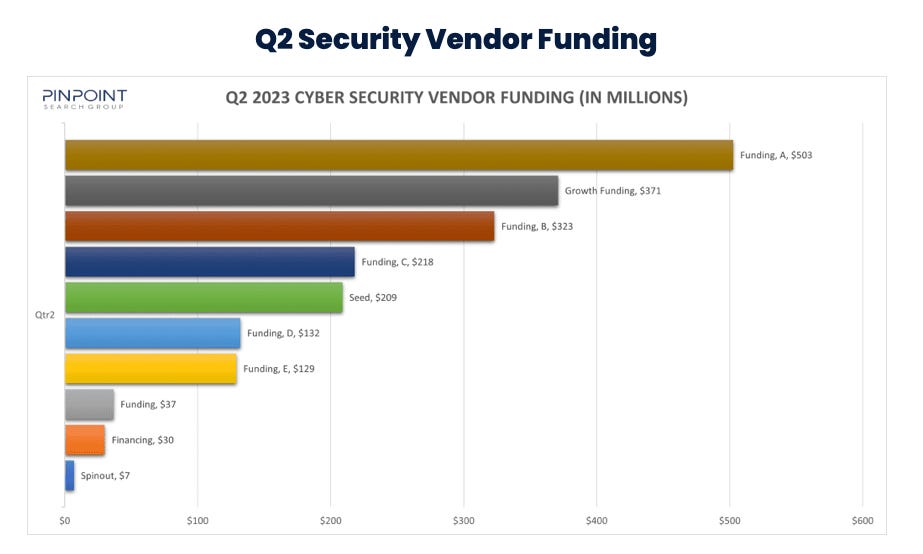

According to the latest findings from the Pinpoint Search Group, the total number of activities in Q2 2023 stood at approximately $1.9 billion. This is close to the $1.6 billion number given by Crunchbase.

$1.6 or $1.9 billion investment in a quarter are significant figures. There is still a lot of demand for cybersecurity solutions. However, Pinpoint reports - as Crunchbase again - the sector experienced a decline in funding of around 55% compared to the same period in the previous year (Q2 2022).

Less startups are created

With the current market conditions, it is unsurprising that the number of created startups has declined in major innovation hubs such as the US, Europe, and Israel. Crunchbase estimates an 86% average drop from 2020 to 2023.

In 2023, we’ve seen 86% less startup created - Crunchbase

In a guest blog post by Itay Sagie, Crunchbase analyzes possible reasons for the decline in startup formation. The COVID outbreak in 2020, the economic downturn in 2022 and beyond, and geopolitical unrest such as the Ukraine war and internal political unrest in Israel are all quoted as potential explanations.

Fewer M&A for Cyberstartups

According to Crunchbase, the first seven months of 2023 saw only 34 cyber startups acquired, putting dealmaking at its slowest pace since 2017.

Despite the slow start, there might be a shift around the midyear point, and there is likely to be a heavy drive toward M&A in Q4 and throughout 2024. Cloud security, AI, supply chain security, fraud detection solutions, and sign-on and verification technologies are among the areas that could see more deals in the coming months.

In 2024, we can probably expect a higher volume of M&A transactions at lower transaction values.

It should be logical to see more M&A activity coming. The valuation we’ve seen since few years were very high, and now VC need to find exit. Few companies are able to go to IPO with the right metrics and be under public scrutiny.

Is it that so bad?

As an entrepreneur, I believe that innovation happens within startups that are free to take risks, build something, and spend time on 4U problems - Unworkable, Urgent, Unavoidable, and Underserved problems (see my previous post). This is how value creation happens. It is disheartening to see fewer companies being created.

However, this presents a significant opportunity to build new businesses. With less competition, entrepreneurs who receive some support and resources to bootstrap their business before raising capital have a great chance of becoming the next champions in 5 to 10 years.

Moreover, I think it is also time to realise that not all companies are made to be a “startup backed by VC”. Many entrepreneurs are building sustainable business, with good growth but not exponential growth. They won’t reach VC metrics and in their heart, they are not ready to do whatever is required to take VC money. They probably should twice on how they wan to

I recommend you have a look to this talk from David Sacks about “VC vs PE - What’s the right framework for thinking about your startup?”. David talks about growth stage startup, looking at a fictional example. Even you are at early stage, you should have a look and use it to plan your next steps.

I extracted this table, I also recommend to think about as a founder.

I also noticed a TechCrunch article that reminds us that investors remain optimistic about the cybersecurity sector. The arrival of generative AI has great potential for building extra features on cyber security products. Moreover, leveling up the resilience, detection, and protection of organizations remains crucial as demonstrated by the new threats and cyberattacks of 2023. TechCrunch is also offering a set of interviews that read I encourage you to check out the article.

NATO opens up a Fund for Cyber

In other news - thanks to Darwin Salzar to point it out -, it has been reported that NATO is opening an investment fund for cybersecurity. While some may question whether a public defense organization like NATO can effectively impact the VC market or would prioritize their own needs, this presents a positive opportunity for defense technology companies that are increasingly adding cybersecurity solutions to their portfolios.

However, serving the military as a cybersecurity software vendor can be challenging. The military has strict requirements for the inner security of products, including obtaining necessary certifications. Due to these challenges, many companies may view NATO's investment as a potential opportunity for growth and development in this field, especially if Defense is one of the vertical markets they focus on.

Limited Partners drive VCs’ secondary market

A recent PitchBook article highlights that the demand for liquidity from limited partners is driving some venture capitalists to sell portfolio company stakes on secondary markets, but buyers are only interested in the best assets. Less attractive companies are not generating much demand, even at significant discounts. The trading of secondary stakes in startups is expected to increase as more firms are pushed by their LPs to generate liquidity. However, the number of companies that investors are interested in buying secondary stakes from is much lower than the over 1,000 unicorns hoping for an exit.

By the way, if these VC/LP/GP/Valuation/Startup/Secondary jargon is hard for you, I put some definition in appendices.

How much should you pay yourself as a European founder

Christoph Janz wrote an interesting article about how much you should pay yourself as a founder. The article is based on an extensive survey of over 950 companies that his company conducted across European founders in the last six months.

He compares Berlin, Amsterdam, Paris, Munich, Barcelona, and Remote founder locations.

Last but not least

I wanted to highlight this tweet from Tobias Gehrke

It's a good reminder that even within the EU 27, venture activity has significantly increased over the last 10 years, with France, Germany, and the Netherlands leading the way. It's worth noting that our dear UK friends, who are not part of the EU, also have a strong venture activity.

BUT we are still lagging behind the top places like the US and even China ☹️

Back to work, Cyber Builders.

See you next week

Laurent 💚

Appendix - Definitions

Here are some definitions:

In finance, a secondary market is where previously issued financial instruments, such as stocks and bonds, are bought and sold. In the context of a startup, the secondary market refers to the buying and selling shares in a startup that has already gone through at least one round of funding.

This allows early investors and employees to sell their shares and realize a return on their investment before the startup goes public or is acquired.

The buyers in the secondary market are typically institutional investors or high-net-worth individuals willing to take on the risk of investing in a privately held company.

A limited partner (LP) is an investor in a venture capital fund who provides the majority of the capital for the fund.

LPs are typically institutional investors such as pension funds, endowments, and foundations, or high-net-worth individuals.

They invest in VC funds with the expectation of earning a return on their investment, but they do not participate in the day-to-day operations of the fund.

Love this! Sharing with a few founders. Great work Laurent!

Thanks Darwin!

Tell the founders that now is time for solid cybersecurity projects but I am sure there are still room.