Balancing Growth and Profitability in 2024 and Beyond for SaaS companies - A new benchmark?

Strategies for Growth and Efficiency - Back to Basics

Hello Cyber Builders 👍

As we prepare for 2024, this post builds on the insights from our previous article, “The New Tech Landscape: Venture Capital and Cybersecurity in Q3 & Q4 2023”. (link)

It's a critical time for SaaS entrepreneurs and CEOs to adapt to an evolving business environment. This article focuses on the importance of growth, efficiency, and financial prudence in the face of rising benchmarks, from the '40-rule' to the more demanding '55-rule'. Don’t worry if you are unfamiliar with the financial metrics; I’ll explain later.

The post is designed to guide startup founders in navigating these changes and setting a robust course for success in the coming year. It is not 100% related to cybersecurity though. My gut feeling is numbers and quartiles are different regarding cybersecurity companies and the VC data I am reusing in the post are more related to SaaS. Nevertheless, even you need to shift expectations, the key parameters remains the same.

In this Post

How the newer '55-rule' is reshaping SaaS industry standards.

The crucial role of sales and growth in tough market conditions.

The importance of Burn Multiple as a measure of capital efficiency.

Evolving Benchmarks: From 40-rule to 55-rule

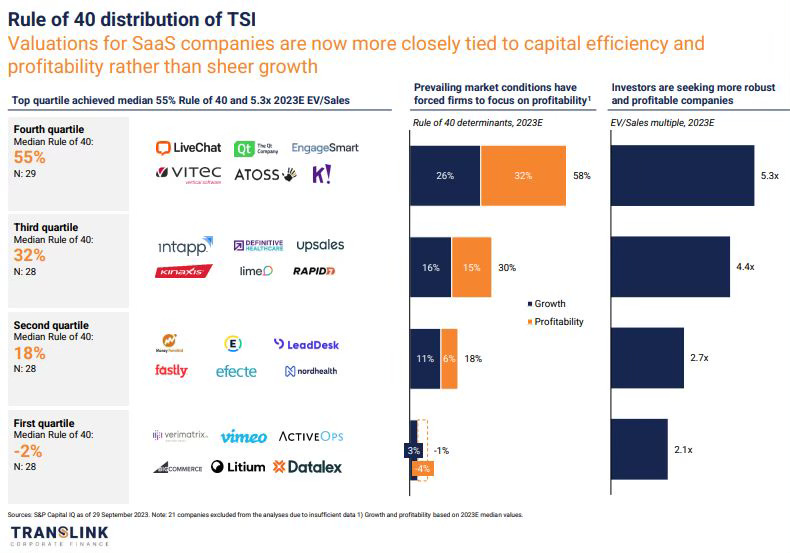

The SaaS (Software as a Service) industry is witnessing a fascinating shift, as highlighted by the latest report from Translink Corporate Finance highlighted by Ivan Michal. This report reveals that the median sum of growth rates and EBITDA margins for top-quartile SaaS companies has reached an impressive 55%.

This statistic is pivotal for understanding the industry's valuation dynamics. Companies in the top quartile are valued significantly higher at 5.3x EV/Sales, compared to just 2.1x for those in the bottom quartile. This disparity underscores the value placed on high performance in the SaaS sector.

Interestingly, the report also indicates a shift in the valuation criteria for SaaS companies. Traditionally, growth has been the primary driver of valuation, but the current trend shows a stronger correlation with profitability. This evolution suggests a maturing market where sustainable profitability is becoming as important as, if not more than, rapid growth.

You may not be fluent in financial metrics for businesses. Let me break this down for you: The "40-rule" in a business context, particularly in software or tech companies, is a benchmark for evaluating a company's performance and investment appeal. A company's combined growth rate and profit margin should equal or exceed 40%. For instance, if a company grows at 30% annually, its profit margin should be at least 10% to meet the 40-rule. This rule is a guideline for balancing growth and profitability, indicating a healthy, sustainable business model. Investors and stakeholders commonly use it to assess the potential and health of a company.

Entrepreneurs must go back to basics.

Shifting from a 40-rule to a 55-rule or 60-rule for entrepreneurs means raising the bar for business performance. This change implies that companies are expected to achieve higher growth rates while maintaining or improving profitability. In this context, "back to basics" means focusing on fundamental business principles: driving growth and keeping costs low.

This dual focus ensures sustainable expansion without compromising financial health. It's a reminder that while chasing growth, efficiency and cost-effectiveness should not be overlooked, as they are crucial for long-term success and stability in a more competitive market.

It also means that Entrepreneurs should not think, “Let’s raise more!” and increase our costs with more marketing expenses and salespeople. Spray-and-pray growth tactics are no longer valid when money costs you 5%/y (e.g., interest rate in US or EU).

Let’s see what does it means and what are the best benchmarks to look at.

The Imperative of Early Growth Metric

Focusing on sales and growth is essential in today's challenging business landscape. For CEOs and founders, actively driving new revenue streams and customer acquisition is crucial, especially in tough times. It's a fundamental aspect of business that should not be delegated, as direct involvement in these areas can significantly impact a company's trajectory and success.

I am meeting with too many startup CEOs that, after reaching the first milestone - their Seed funding - look too quickly to “structure” sales. I believe that a startup CEO must be very involved in sales activities. He/She should be in the details of all its company activities, aligning everyone and sharing the vision repeatedly.

For early-stage startups, initial growth metrics are critical. They send a strong signal to VCs, who pay close attention to these early numbers. It's important to note that growth is measured by acquiring the first customer, not the company's incorporation. So, if your product development takes a considerable time, factor this into your growth calculations and expectations.

To go deeper, the "ChartMogul SaaS Growth Report 2023" comprehensively analyzes SaaS business growth, focusing on how companies grow from zero to over $30M in annual recurring revenue (ARR). Key insights include:

For the typical (median) startup, the growth is:

$1k to $25k MRR => 1y9 months

$25k to $40k - k$50k MRR => 4 months

$50k to $80k MRR => 8 months

Whereas the top decile startups are growing like:

$1k to $25k MRR => 4 months

$25k to $40k - k$50k MRR => 1 months

$50k to $80k MRR => 4 months

Best-in-class SaaS businesses grow over 100% annually, with growth rates varying based on ARR range.

Top-tier SaaS startups typically reach $1M ARR within 9 months, but it takes an average of over five years to reach $10M ARR. Only a small percentage of startups achieve this milestone.

Capital Efficiency: The New SaaS Mantra

In a world where the money tends to be free, I have seen early-stage startups not being careful about money spending and not measuring the return over the capital invested.

In 2024, it is not because a startup has several million in its bank account that it can be a gold sponsor for a local conference or spend a large amount of money on a market study. It can not raise a salesperson who was not meeting its booking numbers.

In such an environment, the “Burn Multiple” metrics are king. The "Burn Multiple" in SaaS metrics is a financial metric that measures how efficiently a company is using its capital to drive revenue growth. It's calculated by dividing the company's net cash burn by the net new annual recurring revenue (ARR) over a specific period.

A lower Burn Multiple suggests a more efficient use of capital, indicating that the company spends less to acquire each additional dollar of ARR. This metric is critical as it helps investors and management balance growth and financial sustainability.

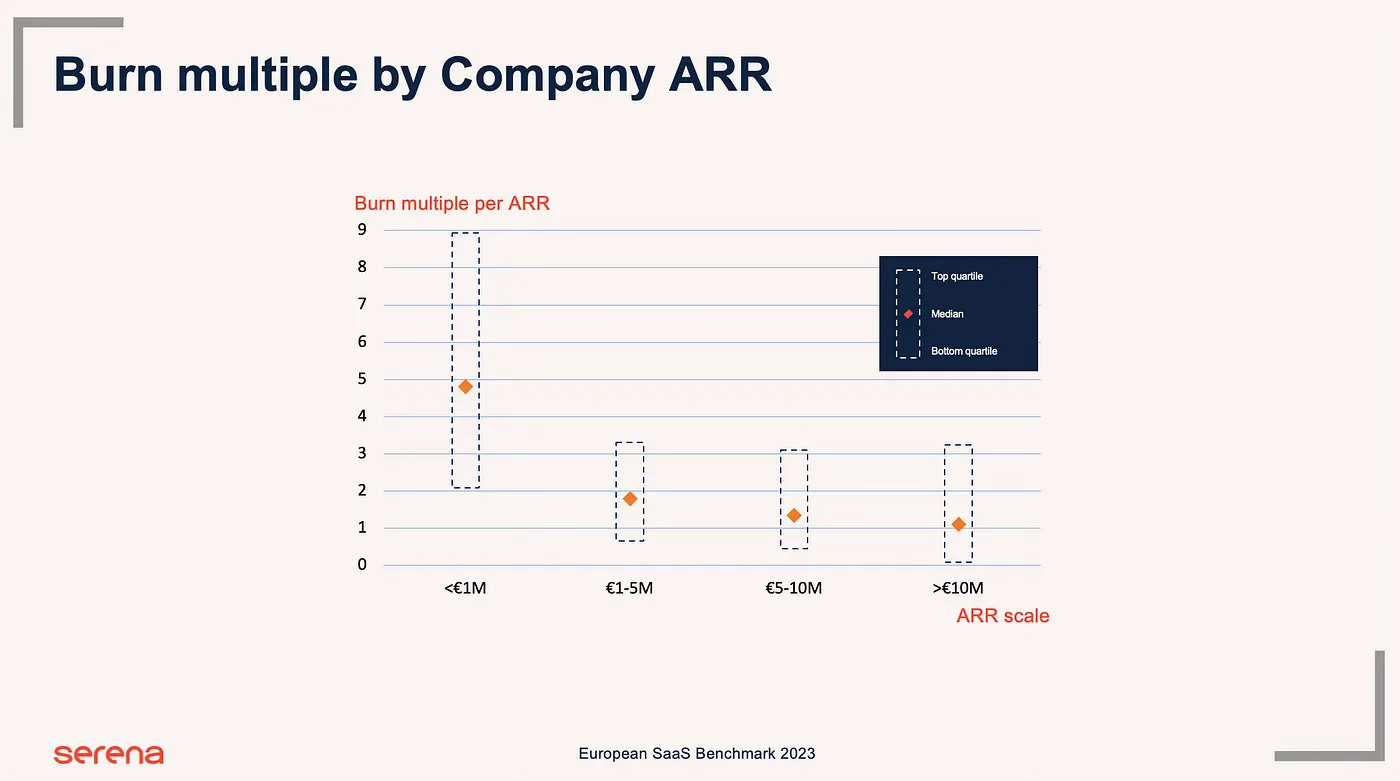

In its European SaaS Benchmark 2023, Serena Capital offers insights about the market standards:

For example, if you burned 1 M€ to add 0.5 M€ in new ARR, your burn multiple is 2x. A burn multiple of greater than 1 indicates that the company is burning cash faster than it is generating revenue, the opposite means that the business is growing efficiently.

Serena Capital - European SaaS Benchmark 2023

It is interesting to note also that the market practices are to be below 2, above 2 it is very suspicious. A burn multiple of 1 (1 dollar spent for 1 dollar of net new revenue) is excellent.

Early-stage cybersecurity companies must have a look at this number. While it is true that the right amount of engineering, sales, and marketing staff is vital for a cybersecurity company, the ratio remains essential.

It also signals how the founders are driving their company.

If there is significant growth but an above 2 burn multiple, It is okay for early-stage companies to kick-start their sales process. It is not ok for a more mature business. It might indicate other issues, such as lousy cost management or high churn (losing too many customers). It shows a company used to get large capital funding.

If there is significant growth but a below 1.5 Burn Multiple, it shows a great sales process at a low cost. Where should we invest more?

Recommendations

Maintain Financial Discipline

Reviewing and managing your expenses is essential to ensure financial discipline consistently. Consider implementing lean operations and avoiding unnecessary spending to optimize your resources.

I’ve seen pre-revenue Seed-stage startups having a more than 130k€ of burn each month. This is crazy as it does not preserve time

Data-Driven Decision Making

Incorporate data analytics to gain insights into customer behavior, market trends, and operational efficiency. Analyzing data allows you to make more informed strategic decisions that align with your business objectives.

Agile Product Development

Adopt an agile approach to product development, allowing you to respond to market needs and customer feedback swiftly. This flexibility enables you to improve and enhance your products to meet evolving demands continuously.

Strengthen Customer Relationships

Establish and nurture strong relationships with your customers. Regularly engage with them to gather feedback and improve your products or services based on their preferences and needs.

Focus on Talent and Team Building

Recognize the importance of investing in talent and team building. Building a skilled and motivated team is crucial for maintaining employee efficiency and productivity. By fostering a positive work environment and providing growth opportunities, you can attract and retain top talent, contributing to the overall success of your business.

Conclusion

In conclusion, as we venture into 2024, the SaaS landscape is undergoing significant changes, with evolving benchmarks like the shift from the '40-rule' to the '55-rule' reshaping industry standards. For entrepreneurs and CEOs in the SaaS sector, this period represents both a challenge and an opportunity to refine their strategies in growth, efficiency, and financial management.

The importance of balancing rapid growth with profitability, mastering capital efficiency, and maintaining an agile, customer-focused approach has never been more crucial. As the SaaS market matures, companies that adapt quickly and effectively to these new norms will not only survive but thrive, setting a robust course for success in the competitive landscape ahead.

Resources

Translink Corporate Finance Q3 2023 - https://translinkcf.fi/wp-content/uploads/2023/10/Translink-Corporate-Finance-SaaS-Valuation-Update-Q3-2023.pdf

ChartMogul - SaaS Growth 2023 - https://chartmogul.com/reports/saas-growth-report/2023/#executive-summary

Serena Capital - European SaaS Benchmark for 2023 - https://blog.serenacapital.com/european-saas-benchmark-2023-e9c33ca94b44