Fewer Cheques, Tougher Checks: Cyber VC in 2025

Reviewing two great reports from Tikehau Capital and Axeleo Capital ; VC Trends of Q1 2025 with a zoom on Europe markets.

Hello Cyber Builders 🖖

Cybersecurity is at the top of everyone's mind, and AI brings more opportunities and threats at the same time. Therefore, we would expect funding levels to be high and investors to be eager to seize opportunities… That would be great, wouldn’t it?

While investment levels are still solid, the number of deals is thinning out. Exits? Barely moving. IPOs? Almost nonexistent. The truth? We’re seeing a maturing ecosystem... with a tightening funnel.

This post is my quarterly review of venture capital (VC) deals in cybersecurity. I am accustomed to conducting these reviews to gain insight into the direction the industry is heading. This quarter, I took a deep dive into two new reports that map out the European cybersecurity VC landscape:

The Tikehau Capital Baromètre 2025 – a 10-year, multi-country view, tracking the market's pulse since 2014. (Read the Tikehau report)

The Axeleo Capital Cybersecurity Index Q1-25 – the freshest snapshot of current dealflow, focused on Europe. (Visit the Axeleo Capital Post)

Both offer strong data. Together, they tell a powerful story: capital remains available, but it’s now picky, strategic, and increasingly concentrated.

VCs are not looking for “good enough.” They’re backing winners—projects with real traction, sharp execution, and clear product differentiation.

In this Post

How cyber VC grew 5.9× globally (12.5× in Europe) and what drove the 2024 rebound.

The U.S. grabbed 85 % of capital, and Q1‑25 deals highlight

Four founder must‑dos: sell more, burn less, stay lean, prove traction.

A Decade in Review (2014–2024) from the Tikehau Capital Baromètre

Let’s zoom out.

Over the last decade, global cybersecurity venture capital funding has increased by 5.9 times. That’s massive.

European funding increased 12.5 times over the same period. Yes, you read that right—twelve and a half times.

So, why doesn’t it feel that way?

In 2024, Europe’s share of global funding decreased. The money is still there, but more of it flows into fewer hands and markets where the perception of return is stronger and faster. And that’s where founders need to pause and ask: What’s signaling “investable” right now?

A few key moments shaped this decade:

2021: The COVID Boom – Cyber became front-page news. Budgets exploded. Everyone scrambled for digital defense as other SaaS applications. Cybersecurity followed the general trends.

2023: The Great Reset – Valuations cooled. Hype died. VCs got cautious.

2024: The Strategic Rebound – Funding returned only for the best-positioned startups. Spray-and-pray is over.

More money - Fewer Deals

The primary trend for 2024 is the concentration of venture capital (VC) money into fewer hands.

In 2024, the amount raised by US cybersecurity companies mostly came from Series C, D and E fundraising rounds (51% of the total amount raised). Growth in the total amount raised (+53% vs. 2023) is mainly attributed to a number of huge rounds (the twelve biggest cybersecurity fundraising rounds in 2024 were all US).

Extracted from the Tikehau report

2024 confirmed what many suspected: the U.S. is back and playing to win.

American startups garnered a staggering 85% of global cyber venture capital, securing all 12 of the year’s megadeals—every single one. From late-stage giants to fresh unicorns, the U.S. is hoovering up the big checks.

Europe? It isn’t very easy.

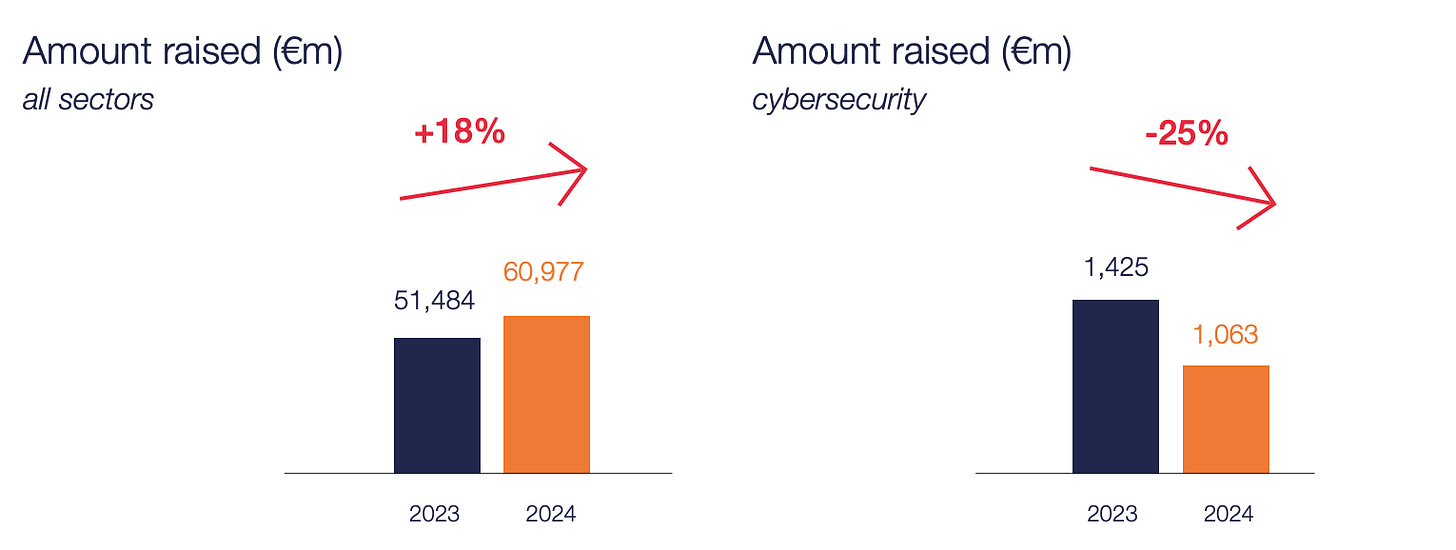

The deal count dropped 16%, and total capital dipped 25% compared to 2023. That’s a significant correction.

On the other hand, France and the UK are now on par in total cybersecurity funding—a first.

Congrats to Whalebone (CZ) – ≈ €13.35 M Series B, DNS‑layer security, and Quantum Industries (AT) – ≈€9 M seed/Series A for quantum‑safe infrastructure

The Q1 2025 pattern is clear:

In the U.S., capital is flooding into all stages, and large late-stage (C, D, and E) deals are happening.

In Europe, investors are still backing Seed and Series A or B, but they’re becoming more selective.

What Founders Should Do About All This

If you’re a founder, the message is clear: You’re not pitching against “the field”—you’re pitching against the top 1% of your segment—time to level up. The bar is higher now.

VCs are still writing checks—but only when they see clear momentum. And in 2025, momentum means customers, revenue, and clear paths to repeatability. This new funding environment rewards focus and discipline. Founders who win today are doing more with less—lean teams, tight execution, and no fluff.

Forget chasing a mega-round to say you raised it. Build a business that doesn’t desperately need one.

Let’s break that down:

Sales traction is your real pitch deck. Investors don’t care about promises—they care about proof. Show consistent growth. Show how you win and keep customers. Show how fast you can turn €1 of burn into €3 of pipeline.

Revenue is your best funding strategy. The more you rely on customer money instead of investor money, the stronger your leverage—and the better your options when you do raise.

Team size isn’t a signal anymore. VCs have seen bloated startups fail. Now, they’re backing teams of 10 doing what used to take 50. That’s efficiency. That’s modern company-building.

Customers > headcount. Clarity > hype. Retention > reach. These are the new metrics.

The shift we’re seeing is more than a cycle—it’s a correction—a hard pivot away from the “growth at all costs” era toward a mindset where real traction outshines raw ambition.

Look at what I wrote 18 months ago: “I need to do three times better.”

Balancing Growth and Profitability in 2024 and Beyond for SaaS companies - A new benchmark?

1️⃣ How the newer '55-rule' is reshaping SaaS industry standards.

2️⃣ The crucial role of sales and growth in tough market conditions.

3️⃣ The importance of Burn Multiple as a measure of capital efficiency.

Conclusion – Cyber’s New Playbook Is Written in Revenue

The data couldn’t be more precise: capital is still on the table, but flows only toward the surest bets. In 2025, that “sure bet” is the founder who can prove three things: repeatable sales, disciplined burn, and a product that de‑risks tomorrow’s threats better than anyone else.

See you next quarter—with more data, deals, and, hopefully, more founders who turned customer revenue into their best funding round yet.

Laurent 💚